Get the perfect solution you need NOW

COMMERCIAL WINE DISPENSER financing

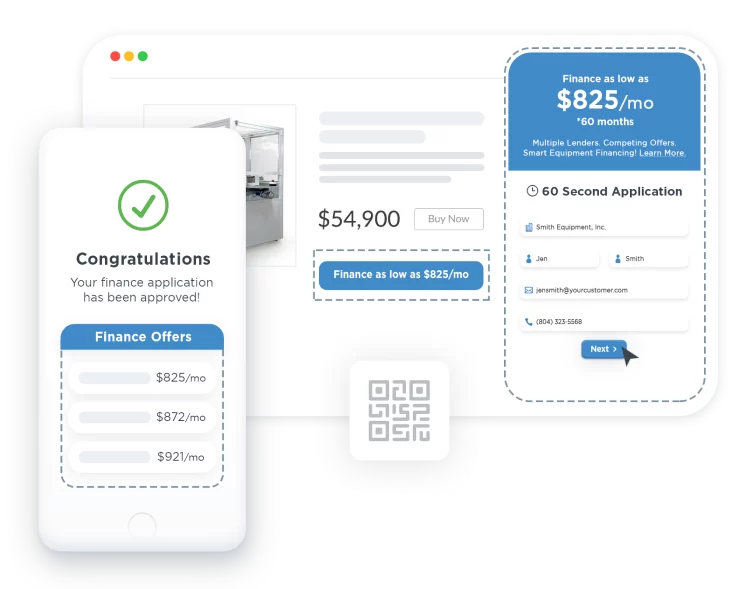

Wineemotion USA’s wine dispenser financing program, powered by our partners at APPROVE, delivers affordable monthly payment options to qualified businesses and even many start-ups!

HOW it WORKS?

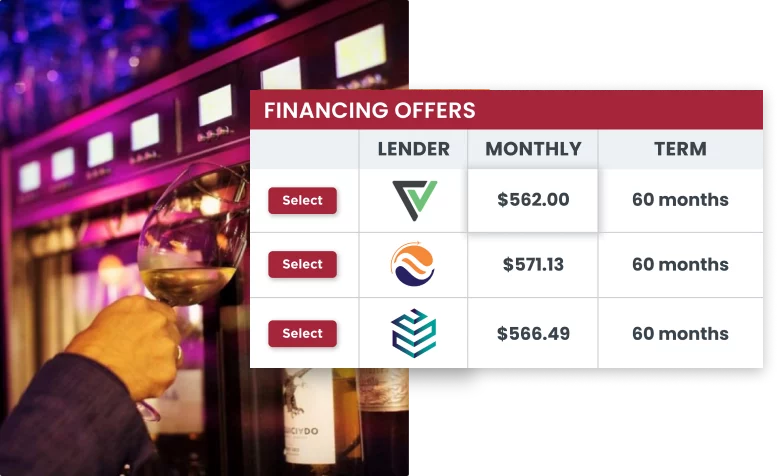

Instead of working with one lender, APPROVE has curated a network of the nation's top equipment finance companies that compete to earn your business!

Submit an application and APPROVE will match it with your 3 "best-fit" lenders.

Receive multiple competing offers to compare side-by-side

Choose the best offer!

WHAT ARE THE BENEFITS?

KEY ADVANTAGES

Financing our WineEmotion commercial equipment offers several advantages that can benefit your business by improving cash flow, providing access to the latest equipment, and offering tax benefits. Here's a summary of the key advantages:

Preservation of Capital: Financing allows your business to preserve its working capital by avoiding the large upfront costs associated with purchasing equipment outright. This can be particularly beneficial for startups and businesses looking to manage their cash flow more effectively.

Flexible Terms and Payments: Financing options often come with flexible repayment terms, allowing businesses to tailor their payments according to their budget and cash flow. Competitive rate financing is available on approved credit, with terms ranging from 24 to 72 months.

IRS 179 Tax Advantages: Lease payments may be fully tax-deductible as an operational expense, providing potential tax benefits to businesses. This can reduce the net cost of leasing and make it an attractive option compared to purchasing.

Improved Cash Flow Management: By converting a large capital expenditure into manageable monthly payments, businesses can better predict and manage their cash flow. This can be especially useful for new or expanding businesses that need to allocate resources across multiple areas.

No Collateral Required: Unlike traditional loans that may require collateral, equipment financing often does not require a down payment or collateral, making it more accessible for many businesses.

Hedge Against Inflation: The fixed monthly payments associated with leasing can act as a hedge against inflation, as payments are made with future, potentially less valuable, dollars. This can result in overall savings over the life of the lease.

Call Today for Pricing or Product Recommendations On Any of Our Top Rated Commercial Equipment.

Models in each product class have a number of options from which you can make your choice.